Financial institutions experience rising demands to meet strict anti-money laundering (AML) regulatory requirements. Financial institutions need to implement advanced tools that detect money laundering techniques because these techniques continue to become more sophisticated. AML systems function to meet these operational requirements.

Modern AML software applications for banks provide banks with robust tools to improve compliance processes and track risks and verify adherence to worldwide financial crime regulations. This piece examines how AML systems in banking operations change compliance structures and minimize financial institutions’ risk exposure through regulatory compliance.

What Is an AML System?

AML systems operate as technologically advanced solutions which help financial institutions stop money laundering activities as well as other financial crimes. AML system use automation to execute AML compliance requirements which span from conducting customer due diligence (CDD) through transaction monitoring and risk scoring and ending with suspicious activity reporting.

The combination of machine learning and artificial intelligence technologies and advanced algorithms enables AML software to process large transaction volumes by finding suspect actions that suggest criminal activities.

Why Are AML Systems Essential in Banking?

Money launderers choose banks as their main targets because they possess worldwide financial connections and execute numerous transactions. Institutions which lack appropriate control systems suffer double damage from regulatory penalties and major damage to their reputation.

- AML systems serve essential functions in the modern banking world due to the following reasons:

- Financial institutions need to follow the USA PATRIOT Act together with EU AML Directives as well as FATF recommendations and local AML regulations.

- Early detection of suspicious behavior diminishes the probability of fraud and terrorist financing and sanctions violations.

The implementation of automated systems creates higher operational efficiency by eliminating manual review tasks and achieving better compliance process speed and accuracy. - A complete AML system in banking institutions consists of the following fundamental elements.

AML software solutions provide banks with essential features to properly handle compliance matters while managing risks. These systems operate according to the following sequence:

1. Customer Due Diligence (CDD) and Onboarding

The AML system starts its operations during the customer onboarding stage. AML software performs automatic identity verification and executes both sanctions screening and PEP (Politically Exposed Persons) checks. The system retrieves current data from worldwide databases to determine risk levels which enables it to identify high-risk customers at the first point of contact.

2. Real-Time Transaction Monitoring

AML monitoring systems operate 24/7 to monitor all customer transactions. AML software implements pre-established rules together with evolving risk evaluation models to find suspicious activities.

- Large or irregular fund transfers

- Unusual transaction patterns

- Structuring/smurfing activities

System alerts activate whenever suspicious activities occur before moving the information to the review stage.

3. Risk Scoring and Profiling

The risk scoring functionality in banking AML software generates adjustable scores which utilize customer activity alongside transaction records and specific behavioral factors. The scores enable compliance officers to direct their attention toward the most serious threats.

4. Alert Management and Case Investigation

The AML system creates extensive alerts after identifying suspicious transaction patterns. The built-in dashboards of the system enable compliance teams to manage investigations and document findings and decide when to file Suspicious Activity Reports (SARs).

5. Automated Regulatory Reporting

Organizations must file both Suspicious Activity Reports (SARs) and Suspicious Transaction Reports (STRs) according to regulatory mandates. AML software enables automated report generation together with submission to regulatory bodies thus decreasing the chances of delayed or incorrect filings.

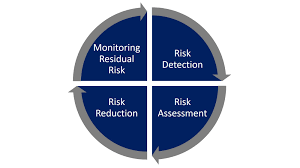

6. Continuous Monitoring and Updates

AML compliance requires ongoing maintenance because it does not have a single finite completion point. Banks need ongoing surveillance. AML monitoring systems maintain active watchlist and risk profile updates through real-time threat detection and regulatory change adaptation.

Benefits of AML Software in Banking

- The implementation of contemporary AML software systems for banks delivers various advantages that include:

- Through artificial intelligence tools banks achieve enhanced detection accuracy by minimizing wrong alarms while maintaining high precision levels.

- System performance allows processing of transactions exceeding one million per day.

- Automation technology reduces expenses related to performing manual compliance tasks.

- The system includes built-in recordkeeping alongside reporting functions which enable full transparency during audit processes.

- The implementation of proactive compliance measures protects organizations from negative public response and media criticism.

Organizations Need to Select Proper AML Software Solutions

A bank should search for AML software which provides the following features:

The software allows users to modify it according to their company-specific risk management guidelines.

- The software operates in cloud environments to facilitate both deployment and scalability.

- The system operates through integration with core banking systems and third-party databases.

Real-time for transaction and customer behavior monitoring - Compliant with local and international AML regulations

AML platforms that are widely used provide their users with APIs along with analytics dashboards and machine learning capabilities to boost decision quality.

The Future of AML Systems in Banking

AML software development seeks to achieve three essential elements for its future: automation capabilities along with intelligent detection systems and adaptable functionality. The evolution of threats combined with stricter regulations will drive banks to implement AI-powered tools which provide:

- Detect emerging money laundering schemes

- Past investigations should be studied to enhance risk modeling capabilities.

- The system needs to provide predictive analysis which enables proactive compliance management strategies.

- The upcoming period requires advanced systems beyond basic manual reviews and static rule sets. The upcoming version of AML monitoring tools will assist banks in transitioning from normal reactive strategies to forward-looking proactive compliance operations.

Conclusion

The challenge of AML compliance stands as a top priority for all banks operating today. Complex financial crime methods alongside rising regulatory standards make traditional methods inadequate for modern AML requirements.

The combination of a well-developed AML system with advanced AML software solutions shields banks from financial crime occurrences while protecting them from regulatory fines and reputational harm. Modern AML software systems for banks provide complete tools which help financial institutions achieve streamlined compliance and lower their risk exposure across all operational levels.

The right investment in AML monitoring systems serves as both a vital necessity and a strategic investment for banks who want to stay secure against future threats.