In recent years, Portfolio Management Services have gained favor among HNIs looking for personalized, high-return, and diverse investment portfolios. Because the way we invest is changing, more investors want to look for options besides the usual ones. Let’s see why PMS is growing as a choice against well-known options like mutual funds, shares, and fixed deposits.

Personalization Tailored to Your Financial Goals

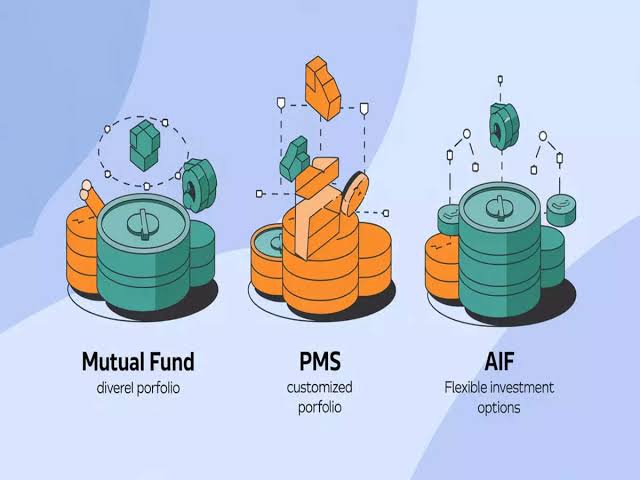

A big advantage of picking PMS instead of traditional investments is the high level of customization available. Unlike mutual funds, which group investors’ money, PMS investing offers a service that matches investment plans to each person’s goals, willingness to take risks, and how long they want to invest. Ongoing changes are made to the portfolio by the manager, based on what is happening in the markets and the investor’s needs, so the investment plan always matches the investor’s goals.

Investment options such as mutual funds or fixed deposits do not usually give the same level of flexibility and customization. These products usually give investors a single strategy, and this may not help them achieve their financial goals over the long term.

Active Management and Expertise

PMS offers active portfolio management, with the manager regularly looking at the portfolio and changing it to take advantage of good opportunities or to stay away from risks. This way of managing portfolios is very different from passive management, often found in index funds and term deposits.

Thanks to the expertise of portfolio managers, PMS investments get the benefit of regular research, analysis, and fast changes to keep the portfolio in line with the investor’s needs. People with a lot of money to invest, usually want higher returns, so this active approach helps them do better than standard options.

Diversification Beyond Conventional Assets

Spreading your money across different assets helps you handle risk better and make more profits. While most traditional investing is limited to stocks or bonds, PMS investment allows you to invest in multiple asset classes. Such options consist of stocks, commodities, real estate, and also structured products.

Structured products, which blend stocks, fixed income instruments, and derivatives, give HNIs with the freedom to construct investment solutions that suit particular goals, such as capital protection or greater returns. By embracing a greater range of asset classes, PMS enables for improved risk management and optimizes possibilities in volatile market situations.

Higher Return Potential

For investors seeking above-average profits, PMS investments frequently provide an enticing option. Traditional investment choices like fixed deposits and bonds give set returns, often lower than what may be gained via equity-based investing. With PMS, the returns are tied to market performance and might potentially be substantially greater, particularly when actively managed by qualified specialists.

As a consequence, for individuals with a long-term investing goal, PMS provides a possibility to dramatically exceed conventional choices. The active management and personalized strategy also give a possibility to collect gains from both bullish and negative market patterns, thus improving the investment potential.

Structured Products for Tailored Risk/Return Profiles

In addition to direct stocks and fixed income, PMS investments sometimes comprise structured instruments. They are designed to meet specific investment goals, such as protecting your capital, getting better returns, or investing in areas usually not open to all investors. Structured products are made up of many features such as derivatives and asset-backed securities and let an investor choose the risk and return that fit them best.

Traditional investing alternatives do not give the same amount of customization. A structured product investment might be an effective alternative for people wishing to attain certain financial objectives while preserving control over risk levels.

Holistic Investment Strategy

Most traditional investment methods are focused on a single asset class, but PMS investments consider a wider range. Portfolio managers put together a strategy that mixes multiple asset classes to help balance risk and rewards. Because of this varied approach, an investor’s portfolio is usually more protected during market ups and downs, a feature not often seen in conventional investments.

Conclusion

PMS investing is an excellent option for high-net-worth investors as the financial world moves forward, due to its personalized approach, expert guidance, and a range of strategies better suited to their needs. PMS targets better returns with less risk, thanks to structured products and other tools, and can help you succeed financially beyond what traditional investments offer. PMS is gaining popularity among people who want to protect their capital, grow their investments, or keep their assets safe.